Note: Following is an eight-part serialization of selected content from Steve Morlidge's The Little (Illustrated) Book of Operational Forecasting.

Note: Following is an eight-part serialization of selected content from Steve Morlidge's The Little (Illustrated) Book of Operational Forecasting.

The quality of forecasts matters…a lot

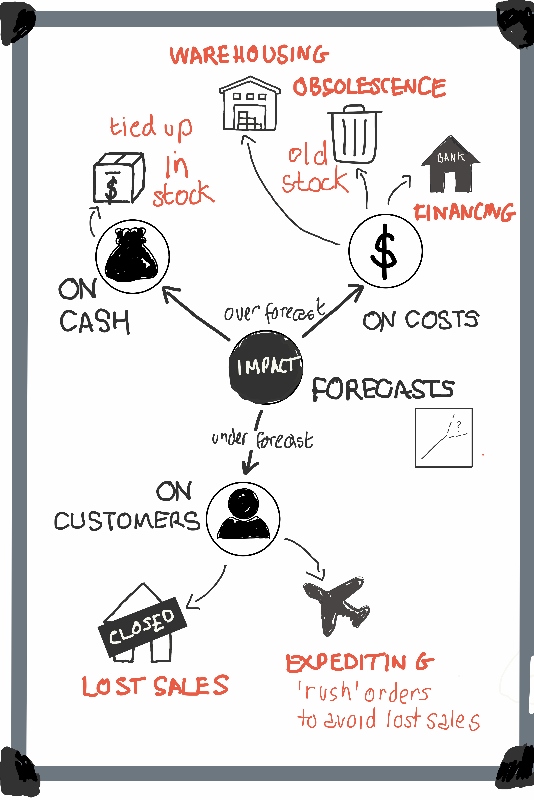

It is difficult to precisely estimate the business impact of forecast quality partly because it impacts so many variables in ways that are not easy to isolate:

- Inventory levels

- Financing costs

- Warehousing costs

- Transport costs

- Expediting costs (incurred when extra product is required at short notice to meet unforecast demand)

- Lost sales

In addition, forecasting can affect the service performance of an organisation, which can have a long-term reputational impact that is difficult to quantify.

Also – as we will discover – it is not straightforward to measure the quality of forecasting in a meaningful way. As a result, most businesses have no idea whether their forecasts are good, bad or indifferent, because they do not know how to measure forecast quality.

What is for sure is that poor forecasting is wasteful and the business impact is huge.

I estimate the unnecessary operating costs of poor forecasting account for 2% of the cost of sales – perhaps 10m for each billion of revenue (assuming a margin of 50%) – and that’s not counting the benefits associated with better customer service.

But the ‘low hanging fruit’ comes from reduced inventory, that across the top 1000 US companies is estimated to be worth $423 billion, with the best performers operating with less than half the level of stock than the median (14 days inventory cover compared to 35).

TAKEOUT

Focus on operational forecasting to improve the bottom line. Poor quality forecasting is the largest unrecognised source of waste in many businesses.

Coming Next: Forecasting is not compulsory

Forecasting as a large-scale structured business process is a relatively recent phenomenon. But most people do not realise that forecasting is an optional activity and that the time and effort expended on it can only be justified if it produces better outcomes than the alternative of simple ‘one in, one out’ replenishment. This lesson explains the economic rationale for forecasting and the criterion for determining where and when it is worthwhile.